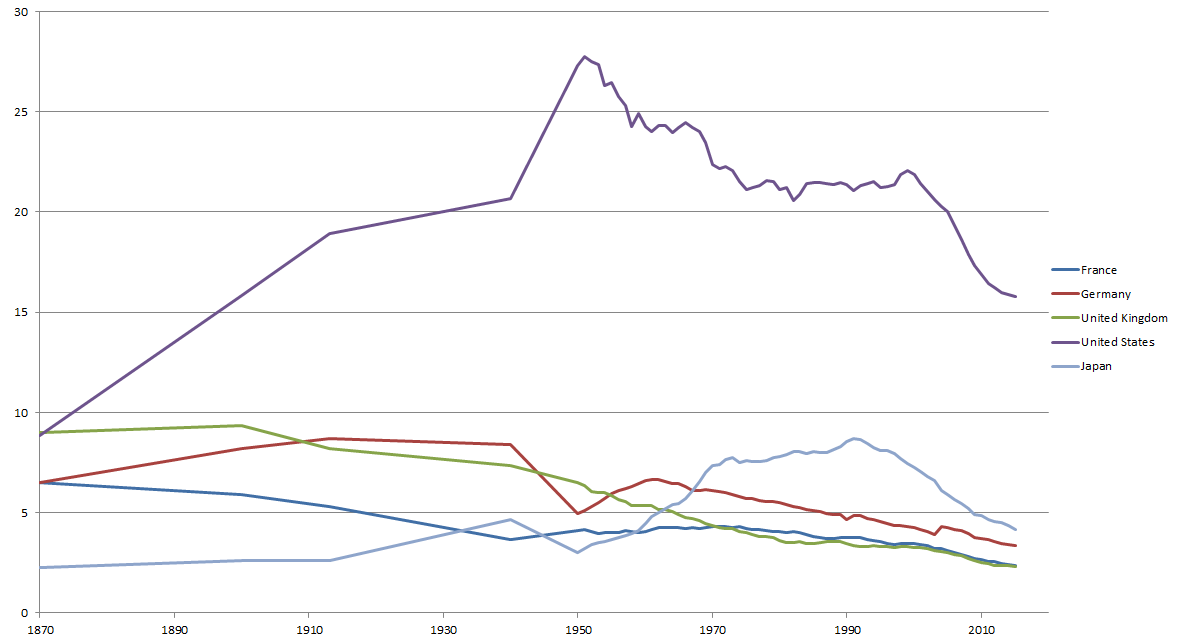

Britain has been in decline for 140 years. By this, I mean that it has been in relative economic decline: relative, that is, to its main rivals and to the overall global economy. The graph below shows Britain (in green) and other countries’ position since 1870, as a percentage of total global income (GDP). The UK had 9% of all global income in 1870, at the height of the British Empire. Today, this has fallen to under 2.4%. The green line shows a remorseless slide downwards.

The last 20 years or so shows that Britain shares this downward trend with the other countries shown. The main reason is the recent rise in the economies of China above all and, to a lesser degree, India, Brazil and Russia.

Referendum Effect

I have previously reported that the UK slipped from 5th to 6th largest economy on the day after the EU referendum. This was the result of the instant drop in the value of sterling. Last week, the Bank of England took action to boost growth by cutting interest rates to the lowest level ever seen. Other measures were announced, including more “quantitative easing” (a.k.a. printing money), to try to stave off a new recession.

At the same time, the Bank of England revised its forecast of growth of the UK economy. For next year, the downward revision from 2.3% growth to only 0.8% marks the greatest ever downward revision by the Bank in its history. A further smaller downward drop was made to the growth forecast for the following year. This will make our national income £45 billion lower in 2018 than expected pre-referendum. Once again, our £7bn cost of EU membership looks a real bargain.

A very poor set of economic indicators of the type used as a guide to future growth provides yet more cause for pessimism.

Prophets of Doom?

Former Chancellor George Osborne has a fetish: it’s called austerity. On taking office in 2010, he tipped the UK back into recession by a combination of poor policy and some foolish talk. Of the latter, his false assertion that the UK economy was like Greece’s was perhaps the most foolish. George has been sacked, but he may yet have helped to make his remarks come true – one day. Under his watch, UK productivity growth has been zero. Our relative position is the worst ever. Our productivity is now 18 percentage points below the average for the world’s major economies (G7). That alone is a strong indicator that Britain will continue to lag behind in economic growth.

The new chancellor seems to be taking his time to learn his brief. The lack of action from him contrasts with the more decisive actions from Carney and the Bank. Expert opinion is that both sets of action are needed. Even that will probably not be enough to repair the damage cause by the referendum result.

Added to all this is Britain’s lopsided economy, with its over-reliance on financial services. With the failed free market fundamentalism still dominant in the UK and at the ECB, Britain is uniquely vulnerable. A characteristic of FMF policies is the increasing likelihood, over time, of bigger and bigger economic crashes of the type last seen in 2007-8. Remember the figures: 1%, 2.5%, 37% from my earlier post Two Gamblers and a Pint of Lager. With 1% of global population and 2.5% of global income, the UK engages in 37% of the world’s speculative financial transactions. These are the kind that are most destructive to the “real” economy, according to the IMF. When the next big crash comes, we’ll be hit hardest.

Terminal Decline?

So, in this context, the referendum result looks to me like the firing shot in the final phase of Britain’s long fall from imperial glory (or hubris): our terminal decline to rancour, intolerance, introspection and global irrelevance. Welcome to the future of Britain!