Before the Tories finally get away with their version of history, let’s look at a few facts….

Debt

In 2010, the UK government debt stood at £1,100 billion pounds, no small sum! But when expressed as a percentage of Gross Domestic Product (GDP) – roughly national “turnover” – this comparison with other countries in 2010 gives some perspective:

Greece: 170%

USA: 90%

France: 110%

Germany: 95%

UK: 60%

So, in comparison with other countries, our debt was relatively small.

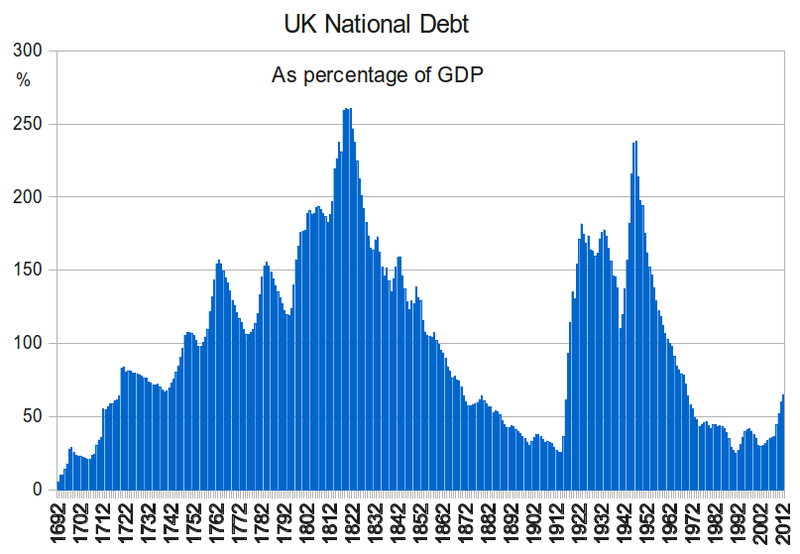

Yes, but how does this compare with past years? This graph gives some perspective:

Over a 300 year perspective, debt rose slowly and then more rapidly to its all-time peak, just after the battle of Waterloo in 1815, of over 2½ years’ GDP. The next 100 years were spent slowly paying off this debt. The years from 1914 to 1945 show a sharp rise, reaching almost the same peak level at 238% of GDP in 1945. It then fell to a low of 29% and has continued to rise after 2010 to around 80% today, the steep rise following the global economic crash in 2008. (It’s worth noting, in passing, that the near-record levels of debt in 1945 did not prevent the Labour government creating the NHS three years later – and that wars are very expensive!!)

Over a 300 year perspective, debt rose slowly and then more rapidly to its all-time peak, just after the battle of Waterloo in 1815, of over 2½ years’ GDP. The next 100 years were spent slowly paying off this debt. The years from 1914 to 1945 show a sharp rise, reaching almost the same peak level at 238% of GDP in 1945. It then fell to a low of 29% and has continued to rise after 2010 to around 80% today, the steep rise following the global economic crash in 2008. (It’s worth noting, in passing, that the near-record levels of debt in 1945 did not prevent the Labour government creating the NHS three years later – and that wars are very expensive!!)

So, debt in 2010 was not exceptionally high by historical standards.

Deficit

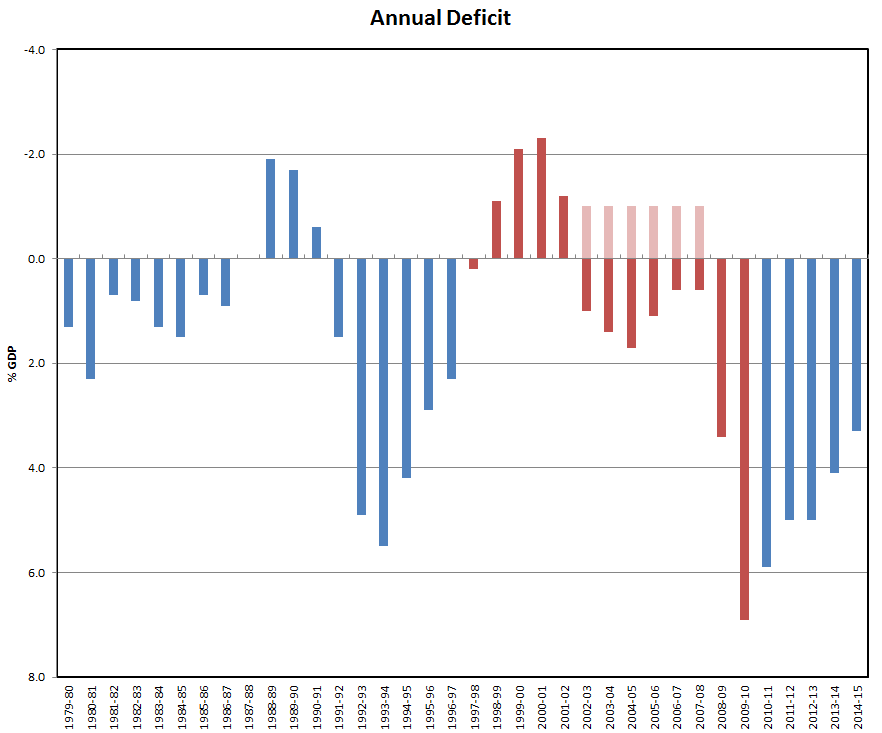

So, what about the deficit: the ability of the government to live within its means in any one year? This graph shows the position since the start of the Thatcher government in 1979:

The solid blue and red bars above show the actual deficit for each year of Conservative (or Conservative-led) and Labour governments respectively. The pale pink shows a hypothetical scenario for the years 2002-3 to 2007-8, which is when the Tories said Labour should have had a budget surplus. I’ve used a fairly arbitrary figure of 1.3%, which, by historical standards, would have been quite an achievement.

The solid blue and red bars above show the actual deficit for each year of Conservative (or Conservative-led) and Labour governments respectively. The pale pink shows a hypothetical scenario for the years 2002-3 to 2007-8, which is when the Tories said Labour should have had a budget surplus. I’ve used a fairly arbitrary figure of 1.3%, which, by historical standards, would have been quite an achievement.

So what can we tell from the figures?

- Their track record shows the Tories are in no position to lecture Labour about budget surpluses!

- At March 2002, the final year of Labour surpluses, national debt stood at 29.3%, close to the record low.

- Six years later, after Labour “profligacy” and at the start of the global crash, it had risen to 36.7%, a rise of just over one percentage point a year.

- In the next two years, deficits rose sharply causing the debt to shoot up another 25 percentage points, to 62%. This resulted from the “nationalisation” of record private debts by rescuing the banks and pumping money into the economy.

- Deficits then slowly decline to around half the 2010 level, in contrast to Osborne’s prediction, at the 2010 “emergency” budget, of eliminating the deficit by 2015.

What conclusions can we draw? On some simplifying assumptions (which work very much in the Tories’ favour), if Brown and Darling had followed Osborne’s retrospective advice, national debt would have fallen to a 300-year low of 25% of GDP at the start of the crash, rather than the actual 37%. This certainly would have helped a bit, but is enormously overshadowed by the effects of the recklessness of the financial sector.

Who’s to Blame?

No one saw the crash coming in 2007-8. Mervyn King, Governor of the Bank of England said it wasn’t Labour’s fault, but rather “a shared intellectual view right across the entire political spectrum”. Even using my simplifying calculations (heavily biased in the Tories’ favour), blame would be apportioned:

- 80% financial sector

- 20% Labour Government.

And that’s before we even consider the benefits (Sure Start centres, increased NHS spending, etc.) that the extra money was used for.

One final thought about numbers – just a coincidence, I’m sure:

- 37%: National debt at the start of the crash

- 37%: Proportion of the vote to secure a Tory Government in 2015.

It’s a funny old world, isn’t it?